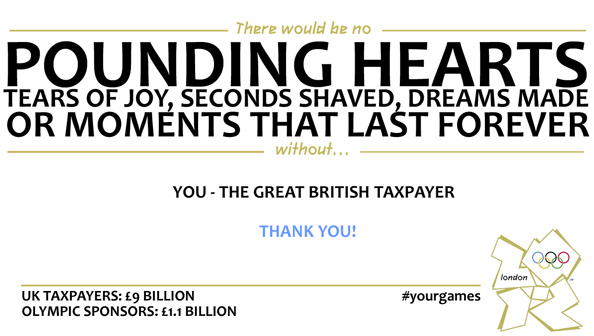

So when I saw the following edited billboard from the London 2012 Games posted at Make Wealth History, I started to question the other side of the equation.

Our initial reaction when you see that £9 billion has been spent by UK taxpayers to bring about the games is probably one of disgust. And rightly so – we never voted to have the Olympics; the Olympics supports London far more than the interests of the rest of the UK; and we are forced to pay for something whether or not we support it, or gain any benefit from it. Altogether, that means that the decision to spend UK taxpayers’ money on the games is controversial.

But once you get past the selfish view of economics that we take as individuals, and instead look at the economics of the country and our society as a whole, this money was well spent. I’ll tell you why: Think for a moment about what costs the Olympics have had to face. The costs that come to my mind are the design, engineering and building of Olympic venues and huge numbers of event staff to pay for their various services, from security to ball-boy. With very few exceptions, that money got delivered straight back into the UK economy as wages.

And will the government get back any of that? Of course! Their employees will pay income tax and the businesses that ride on the Olympic wave will pay their rates and taxes (in part thanks to our friends at 38 degrees).

So let’s compare that to bank bailouts.

In this graphic from the Guardian, you can see equivalents to the £38 bn figure for bank recapitalisation in 2009, but this figure has since risen to £123 bn, according to this article, again from the Guardian, so rather than four we could have actually bought more than 13 Olympic games for the current bank bailout money!

But that’s not really the point, because the more significant thing is where this money goes. As we have all seen during recent years, the money that banks were given by the government did not go towards supporting our productive economy in loans to companies and entrepreneurs, and it did not go towards the wages of vulnerable low income families. Banks selfishly continued to pay out huge sums in salaries, bonuses and make huge profits, ensuring that any benefit that came of the bailout remained firmly under the control of bankers, so that they could continue speculating on property and gambling with the world’s economy, whilst leaving the productive economy to fend for itself.

To be honest, I’m not at all surprised that bankers would take this kind of action. If I were in their shoes, I may well have done the same (such is man’s fallibility), but what this does indicate, I feel, is that our economic system isn’t really designed to help society as a whole to develop and prosper. It is designed as a game, where the winner takes all, and those who are unable to participate – through not knowing the rules, or not having the right friends, or not having enough cash in the bank already – must beg for the mercy of those who do.

Did we have a choice to bailout the banks?

Some people would argue that the government had practically no choice in bailing out the banks, because to have let them fail would have been catastrophic to our economy. Those who take the opposite corner usually do so with the neat little phrase “bail out the people, not the banks”. The argument goes that the government should let banks fail, whilst guaranteeing the personal liabilities that the bank holds. Who knows whether such action would have consumed as much money as bailouts, or have made pension funds fall flat on their faces and left millions of vulnerable pensioners without?

But what we can see is that the recipients of money from the Olympics were more diverse and more deserving than the banks, and created a more pleasing result for the millions of people who watched the Olympics, in London and around the world.

Disclaimer: I’m not an economist, and therefore may not be able to defend claims that I make in this article, so if you know more about this issue than I do, please correct me in the comments below!

Images: Billboard from Make Wealth History website; infographic from Guardian website.

Stimulus for the banks again

ReplyDeleteGive the money to the lower half of wage earners that ( Australia did that), will stimulate things and perhaps people will also pay off debt (Banks would not love that!!!). The figure stands at £3,000 per person.

This would require a dynamic change of thinking by the government that fiscal policy will not allow at present.